In its February 28 report, Baker Hughes stated that U.S. energy companies added oil and gas rigs for the fifth consecutive week, marking the first such streak since May 2022.

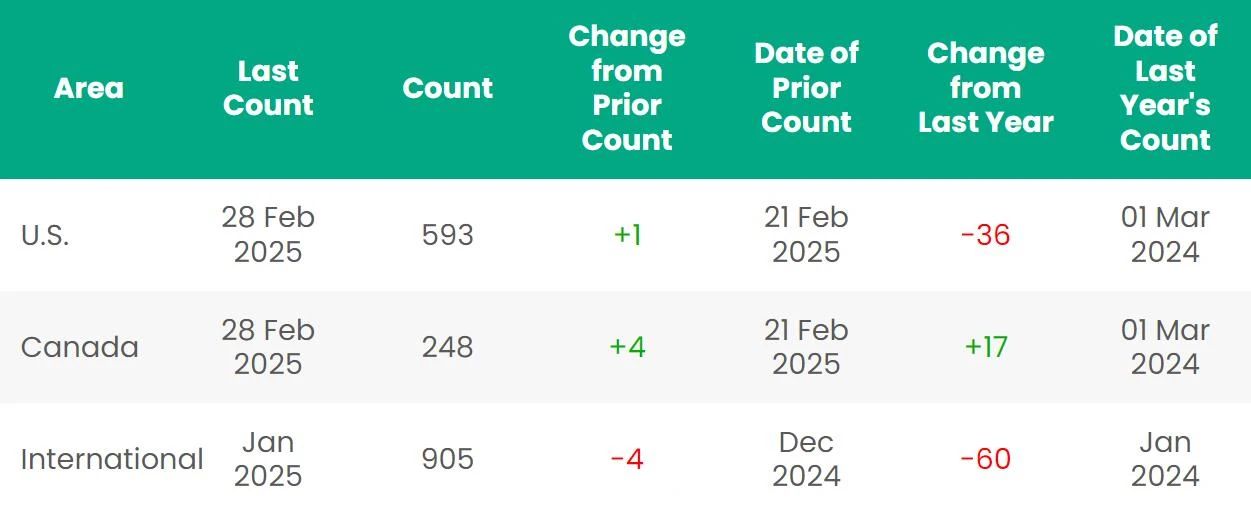

As an early indicator of future production, the total oil and gas rig count increased by 1 to 593 in the week ending February 28, reaching its highest level since June 2023.

Despite the weekly gain, Baker Hughes noted that the total rig count remains 36 lower than the same period last year, reflecting a 6% year-on-year decrease.

The report detailed a reduction of 2 oil rigs this week, bringing the total to 486, while gas rigs rose by 3 to 102.

In February, the total oil and gas rig count climbed by 11, the largest monthly increase since November 2022. Oil rigs accounted for 7 of this increase (also the largest monthly gain since November 2022), with gas rigs contributing 4.

**Long-Term Trends and Industry Shifts**

U.S. oil and gas rig counts have declined by approximately 5% in 2024 and 20% in 2023, driven by falling energy prices in recent years. This has prompted energy firms to prioritize shareholder returns and debt reduction over production growth.

TD Cowen, a U.S. financial services firm, tracked 22 independent exploration and production (E&P) companies, revealing that on average, they plan to cut 2025 capital expenditures by about 1% compared to 2024 levels.

In comparison:

- 2024 expenditures are projected to remain flat year-on-year.

- 2023 saw a 27% increase in spending.

- 2022 recorded a 40% surge.

- 2021 posted a modest 4% rise.

*Reprinted from:《Petroleum & Equipment》February 2025 e-Journal*

*Follow our official account and browse the homepage menu for more information and e-journals.*